How will Kikoff Repair Your Credit?

DISCLOSURE: THIS POST MAY CONTAIN AFFILIATE LINKS, MEANING I GET A COMMISSION IF YOU DECIDE TO MAKE A PURCHASE THROUGH MY LINKS, AT NO COST TO YOU!

In the last few years, there has been a rise in people with bad credit who are still getting loans. It is partly due to a lack of local banks, lender choices, and online lenders that make the loan application process more manageable.

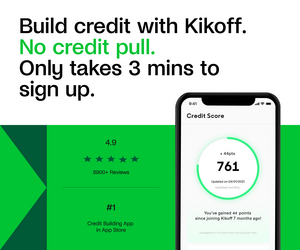

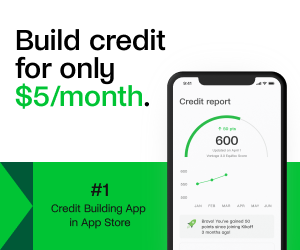

If you want to repair your credit, you’ve come to the right place! Kikoff offers a variety of different credit repair services that can help you raise your score in no time!

What is the Kikoff Credit Account?

The Kikoff Credit Account is a free credit repair product that is easy to use and helps you establish a new credit score. The account features 2$ monthly fees and no hidden costs.

With this account, you can easily monitor your credit score with Credit Karma, which is available on both the Apple Store and Google Play store. With the credit card feature, you can also monitor your credit card spending on Credit Karma.

How Does a Kikoff Credit Account Work?

First, sign up with Kikoff, and you will immediately have access to a $750 credit line. When your account has been established, you can make a credit purchase at the Kikoff store. Kikoff will establish a minimum payment plan for you after you have made a purchase.

This plan will begin around three weeks after your purchase and will continue on a monthly basis after that. Your loan will be reported, along with your payment history, to all three credit reporting bureaus, which are Equifax, Experian, and TransUnion. The company will notify them about the loan.

There is no advantage to paying off your loan early when you have a line of credit with Kikoff because there are no fees or interest charged on the line of credit. Your account age and payment history will grow due to stretching out the payments, which also makes them cheaper.

When you have finished paying off your initial purchase, you should immediately purchase another one on credit to begin the process again.

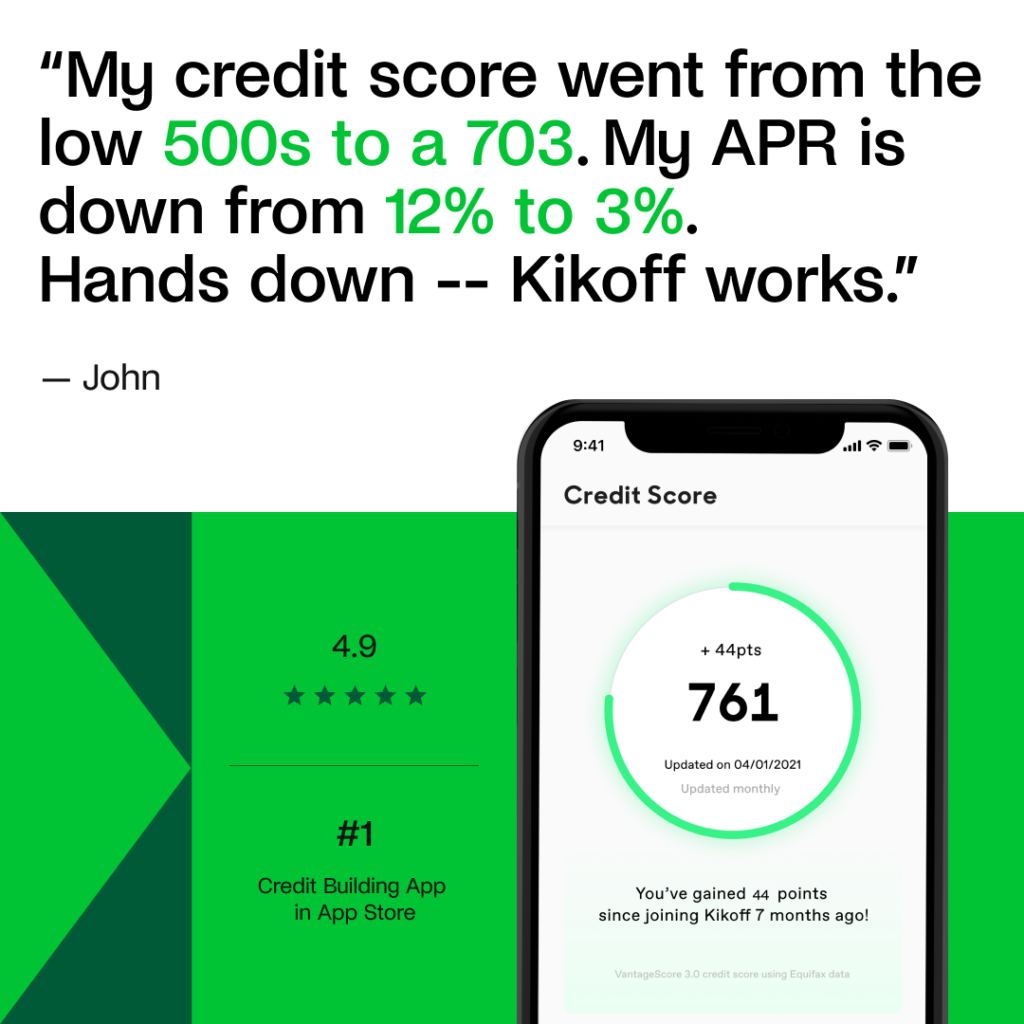

The Kikoff line of credit can improve several aspects of your credit score, including your payment history, credit utilization ratio, and the age of your credit accounts.

A low credit score can also make finding a job or housing difficult. At Kikoff, we know that at a successful business two most essential parts are customer service and social security. Just ask Steph Curry who backed up Kikoff with 42 million to help build credit for the new millennials and GenZ.

What You Need to Know About a Kikoff Line of Credit

Kikoff has been in the credit business for over three years. By providing customers with a line of credit that is flexible and tailored to their individual needs, Kikoff has become one of the most popular lenders in the country.

Some of the Features of using a Kikoff line of credit include that it is:

- Flexible

One of the important features of a Kikoff line of credit is that it is flexible. It means you can use it to meet your short-term financial needs and longer-term goals.

- Customized

Another critical feature of a Kikoff line of credit is customized to fit your needs. It means you can choose which terms and conditions are best for you, and you won’t have to worry about any pre-existing restrictions.

- Convenient

One of the main benefits of using a Kikoff line of credit is that it is convenient. It means that you can get access to your funds quickly and easily without having to go through any long and complicated processes.

If you’re looking for a reliable and convenient lender to help you meet your short-term financial needs, a Kikoff line of credit may be the perfect option.

The Best Way to Improve Your Credit Score

If you’re like most people, your credit score isn’t as good as it could be. That’s because there are many things you can do to improve your credit rating, and the best way to do that is through a credit repair plan with a reputable credit counseling agency like Kikoff Repair.

When you work with Kikoff Repair, Kikoff will help you rebuild your credit history from the ground up by correcting any mistakes on your credit report, including anything that may have lowered your score. Kikoff will also provide you with ongoing support throughout the process so that you stay on top of your credit situation and keep improving your score.

So, if you want to improve your credit score and get back into a good financial position, don’t hesitate to reach out to Kikoff Repair. Kikoff can help you get started on the path to bettering your credit rating today!

What Are the Benefits of Getting a Credit Repair?

There are many benefits to seeking credit repair services. The main reasons are that these services can help you improve your credit score, access new credit opportunities, and raise your credit utilization percentage.

If you have poor credit, a lower credit score can make it difficult to get approved for a loan or to find a good interest rate on an existing loan. A lower credit score also can lead to higher interest rates on loans and fees when borrowing money.

Credit repair can help improve your credit score by correcting any errors on your report. It includes things like missed payments, incorrect information, and incomplete applications. By fixing these mistakes, you may reduce the number of inquiries about your account and improve your chances of being approved for future loans.

If you have low credit utilization, this means that you are using the available credit on your accounts efficiently. A high credit utilization ratio can indicate that you are overextending yourself, which could lead to difficulty getting loans in the future. Correcting low credit utilization can help you get more favorable terms on loans and boost your overall borrowing power.

Credit repair services can also help you find new opportunities for borrowing money. By improving your Credit Score, you may get lower interest rates on loans you already have or qualify for new loans you wouldn’t have been approved for.

Finally, credit repair can help you improve your credit utilization percentage. It is simply the percentage of your available credit that you are using. Reducing your credit utilization percentage will help improve your overall borrowing power and could lead to lower interest rates on existing loans.

Do You Need to Pay Anything to Get Your Credit Repaired by Kikoff?

No, there is no cost to have your credit repaired by Kikoff. Kikoff offers a free initial consultation to help you understand your options and assess the severity of your credit problems. If you decide to hire Kikoff, you only pay for the services needed to repair your credit.

How Long Will It Take for My Credit Score to Go Up with Kikoff?

The good news is that with Kikoff, you can expect a noticeable improvement in your credit score within just two weeks. With our unique approach to repairing your credit, Kikoff’s confident that you’ll see a drastic change in your FICO score and perhaps even get it back up to where it was before the damage occurred.

Do I Have to Be in Debt or Have Bad Credit to Work with Kikoff?

No, you do not have to be in debt or have bad credit to work with Kikoff. Kikoff offers a wide range of services to those who need help repairing their credit.

How Can I Cancel Kikoff?

You can contact support and know that when you close your account, Kikoff will send you a final credit report with all the information about your credit history.

How Is Kikoff’s Customer Service?

Kikoff has an excellent customer service department. They are always willing to help out and go the extra mile to make sure that their customers are satisfied. They are prompt in responding to emails and phone calls and always seem to take the time to listen to what the customer is saying.

They are also very patient, which is something that is often hard to find in today’s world. I would recommend using Kikoff for all of your customer service needs!

Is Kikoff Legit?

Yes, Kikoff is entirely legit and will show up on credit reports. It is the essential part of getting your credit back on track.

Is Kikoff Worth it?

There are a lot of credit repair companies out there, and it can be hard to decide which one is right for you. But if you’re looking for a company with a good track record, Kikoff might be worth considering.

Conclusion

If you’re looking to build your credit score fast, Kikoff is the best option on the market. You can save money on your monthly payments and get back on track with your credit score. If you’re struggling to get through your credit report, Kikoff can help.

Kikoff has years of experience repairing damaged credit reports and can provide you with a detailed analysis of your current situation and how Kikoff can repair it. To learn more, contact Kikoff today.

Thanks for reading this article and if you like this kind of content don’t forget to sign up for our weekly posts. You are sure to get some value!

![]()